Muskoka Market Update

The Muskoka real estate market fell short in the third quarter in a year over year comparison. Despite the drop, the numbers actually marked an improvement from the first two quarters of the year – which saw an aggregated downturn of over 35%.

Downward pressure was applied across many fronts; low inventory, a cooling GTA market, consumer edginess regarding changing U.S. relations, and a general cooling following the frenzied activity in 2016 and 2017.

Third quarter residential sales hit 216, a drop of 11% from 2017 and recreational sales fell by 19% with sales of 240 units from 295 in the third quarter of 2017.

Prices

Average and median prices continued to climb, although the rate of appreciation slowed slightly. The average price for a residential home in Muskoka in the first nine months of the year increased by 8% to $359,728 and median price rose by 9% to $346,000 in the first none months of the year.

Recreational property prices saw average prices increase by 4.14% to $1,060,497 and median prices surge by 15.4% to $750,000. This gap in average and median growth was driven by two factors; price increases across most price points which drives the median value; and a stall at the top end (3M+) of the market which softened average price.

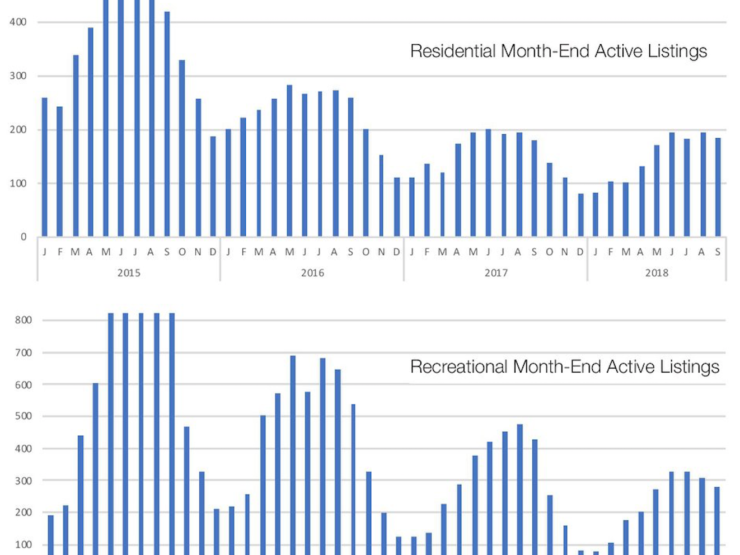

Inventory

Available properties still remained exceptionally low. At the end of September only 184 residential listings and 279 recreational listings were available for sale. This continues the trend we’ve seen for the last couple years and remains, in my opinion, the single largest factor driving prices and restraining sales.